Owing money to the tax authorities can be a daunting and overwhelming experience for anyone. The key to effectively managing and overcoming tax debt lies in understanding the nature of the debt, assessing available relief options, and creating a plan to prevent future financial difficulties. Navigating this process requires patience, diligence, and, often, professional assistance. Whether you’re an individual or a business owner, addressing your tax debt proactively can pave the way to financial recovery and peace of mind. Keep reading for a comprehensive guide on moving forward after-tax debt.

Understanding Tax Debt and Its Psychological Impact

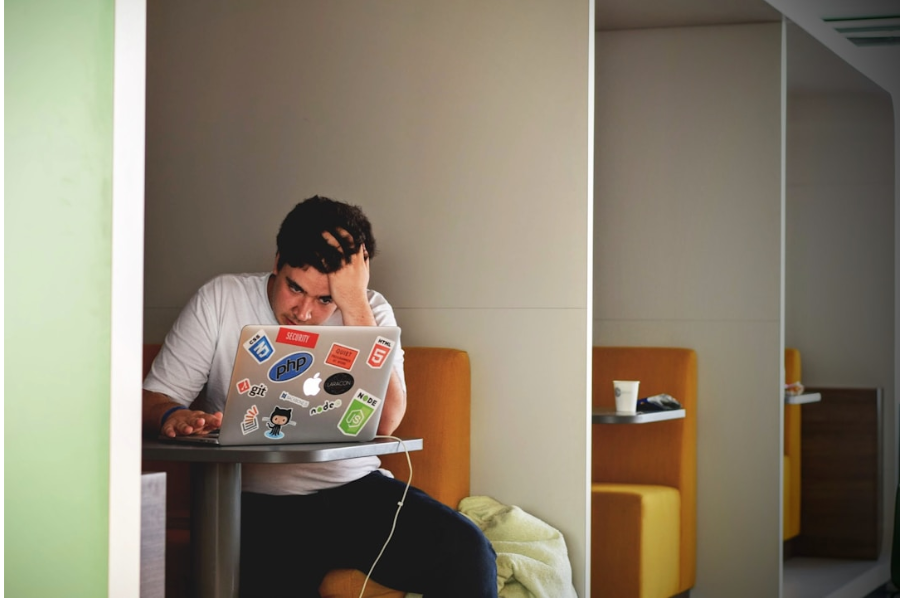

Dealing with tax debt goes beyond the financial strain; it also weighs heavily on a person’s mental well-being. The constant worry over paying what you owe, coupled with the fear of potential legal consequences, can lead to anxiety and stress. Many individuals find themselves losing sleep, facing strained relationships, or even experiencing depression as the pressure mounts.

The stigma associated with debt can compound these psychological challenges, making individuals feel isolated or ashamed. It’s important for those struggling with tax debt to recognize that they’re not alone. Millions of people have found themselves in similar predicaments, and there are structured paths to resolution.

Taxpayers should also be aware that resources are available to help them navigate the complexities of tax debt. From consulting financial advisors to utilizing tax relief services, multiple avenues exist to support individuals through this challenging time. Tapping into such resources can help alleviate the psychological burden and propel one toward tangible solutions.

Creating a Sustainable Financial Plan Post-Tax Debt

Once a path to managing tax debt has been established, creating a sustainable financial plan is essential to prevent recurrence. This plan starts with a comprehensive budget that accounts for all income, expenses, and debt payments. It’s important to live within one’s means and to prioritize tax obligations moving forward.

In addition to budgeting, it is prudent to set up an emergency fund as a safety net to cover unexpected expenses that might otherwise lead to new debt. Consistent contributions to this fund, even in small amounts, can make a difference in financial resilience.

For individuals seeking to deepen their financial understanding, pursuing educational opportunities, such as post master’s nurse practitioner programs, can provide valuable knowledge and skills that are transferable to personal financial management. Continual learning can empower taxpayers to make better financial decisions going forward.

Legal Considerations and Rights When Dealing With Tax Debt

Understanding legal considerations and taxpayer rights is crucial when navigating tax debt. Every individual has the right to privacy and courtesy from tax authorities. This includes the right to understand why they owe what they do and how they can contest the debt if there are discrepancies.

It’s crucial to become acquainted with the tax resolution process as well. Taxpayers are entitled to representation, whether by a certified public accountant, a tax attorney, or an enrolled agent, who can advocate on their behalf. A professional can effectively navigate legal complexities that may be confusing for the average person.

The statute of limitations is another important legal factor. There is generally a ten-year period during which the IRS can attempt to collect outstanding tax liabilities. Understanding this timeline is fundamental, as it influences the negotiation strategy and potential outcomes.

Rebuilding Credit and Financial Reputation After Settling Tax Debt

Settling tax debt is a significant milestone, but rebuilding credit and financial reputation takes time and concerted effort. After resolving tax debt, it’s crucial to check credit reports for inaccuracies that can affect credit scores and to ensure that all information is current and accurate.

Responsible use of credit going forward is essential. This includes paying all bills on time, maintaining low credit balances, and not opening unnecessary new lines of credit, as these habits will gradually improve your credit score.

It is also beneficial to maintain a dialogue with creditors and lenders, especially if there’s a history of tax debt. Being transparent about past issues and showing proof of resolution can help rebuild trust and may ease future borrowing terms.

Altogether, overcoming tax debt requires a multifaceted approach, blending practical financial strategies with an understanding of one’s rights and the psychological effects of debt. By taking the right steps and seeking appropriate guidance, individuals can emerge from the shadow of tax debt stronger and more financially savvy than before. Overall, it’s a journey that, while challenging, leads to growth, stability, and the restoration of financial freedom.